Recently, the price of digital assets like Bitcoin has risen to $70,916 per Bitcoin (about $40,000 per Bitcoin in early 2024), making many more interested. But this year there will be an important event to watch out for in the industry: the Bitcoin halving. But what is this? And how will this affect the overall market?

How many times has Bitcoin Halving happened in the past? And what effect does it have?

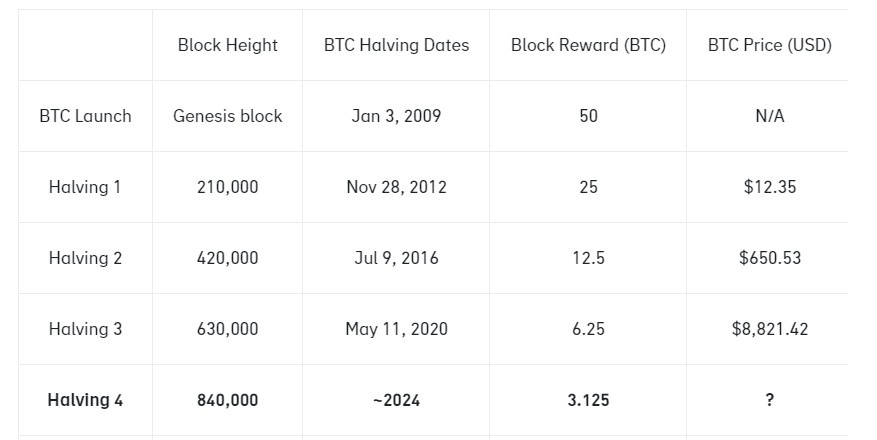

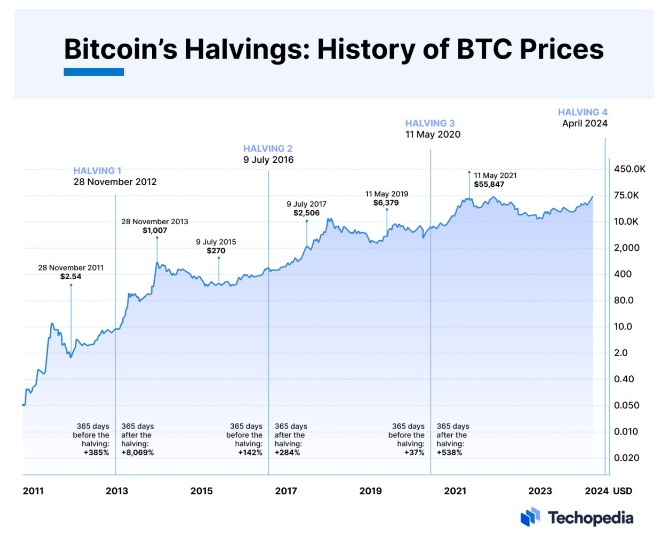

Bitcoin Halving is an event where the 'reward' (Bitcoin) from mining is “halved” every 210,000 blocks, which takes about 4 years. This is considered a mechanism to limit the increase in Bitcoin supply. A set of instructions. This has been embedded in Bitcoin's design since the beginning. In the past, Bitcoin crash has happened 3 times and 2024 will be the 4th time.

Nirun Phuwathananukul is the CEO of Gulf Finance Bitcoin Halving is described as a mechanism to stabilize and control the number of Bitcoins. Given that it is similar to the inflation rate of various currencies, Bitcoin's limited supply (21 million coins) will lead to long-term value. and adapt to long-term value retention.

Bitcoin has halved 3 times in the past and from the statistics you can see the price trend. It is estimated that the 4th bitcoin halving will take place between April 19-20, 2024, although some periods will sell to profit from higher prices.

Source: Techopedia

Bitcoin Halves 4th Time, But Price May Not Increase.

Niran said that this 4th Bitcoin Halve sees the price of Bitcoin not increase too much. Because this stage is different from other times. Because now the price has increased a lot in the past (as of April 12, the price of bitcoin was $70,916, up from about $40,000 at the beginning of the year).

In addition, one factor that could prevent the price of Bitcoin from increasing after a halving is if there is a situation that affects confidence in the industry, which is the reason why the price of Bitcoin has fallen sharply in the past. Luna Coin has issues and cases of being hacked. Or the bankruptcy of one of the world's biggest companies like the Chamber of Commerce cryptocurrency FTX, etc.

(Bitcoin prices will plummet in 2022, falling to $16,000 per coin Bitcoin The previous high was around $64,000 in 2021).

But overall, Bitcoin prices can still be seen as fluctuating. And if an unexpected situation occurs, it may have an impact in the short term. But in the long term, Bitcoin has factors that can support its price. It has piqued the interest of financial institutions. And there are other innovations like the token BRC-20 standard used by the Ordinals protocol that saw some money brought into the market by cryptocurrency and further improving the market structure.

Nirun Phuvattananukul is the CEO of Gulf Finance

When financial institutions hold more Bitcoin, how much of an impact does that have on price volatility?

Holding page Bitcoin In the market, after Bitcoin ETFs were launched 3 months ago, Niran cited data from research that 11 funds held about 800,000 Bitcoin coins, which is considered to be growing very quickly, while Binance (global) holds a stake of 19-20 million Bitcoin coins mined so far.

In principle, financial institutions that own Bitcoin can sell them in the same way they sell other securities and stocks. If there is a wholesale sell-off, it will affect the price of the currency downwards, but ETFs are seen as funds that depend on the movements of the entire market. And saw that the company focused on holding Bitcoin rather than selling it

Gulf Finance, which expects to have the No. 2 market share in Thailand by the end of the year, is preparing a campaign to educate the bitcoin half.

In 2024, Binance through Gulf Finance has prepared a campaign to build knowledge and understanding of TH digital assets and Bitcoin halving, which will be launched after Songkran 2024. However, after launching in January this year, the company is a wholesaler. Currently, it is believed to have a market share of 3-4% of transactions in Thailand, and is expected to move to 2nd place by the end of this year and maintain its goal of becoming No.1 in the long term.

Currently, although the exchange with the highest trading volume in Thailand has a ratio of 80%, the company believes that with Binance's strength and expertise, it can attract investors and bring interesting coins that the market has in view, including quickly bringing interesting coins to the Thai market.

However, Thailand's main challenge is still unclear tax issues such as importing currencies into the Thai currency, how to calculate profits and how to identify cost points for paying taxes. These concerns cause the majority of Thai investors to still trade through the P2P (Peer to Peer) system. Therefore, it is believed that if the government department clarifies, it will be more profitable for the industry.

Other interesting stories: “When committed, it must be done.” The heart of 60 years of success in beauty gems – Suryon Srirathaikul

Don't miss articles and other interesting stories. Follow us on Facebook at Forbes Thailand Magazine.

“Avid gamer. Social media geek. Proud troublemaker. Thinker. Travel fan. Problem solver.”