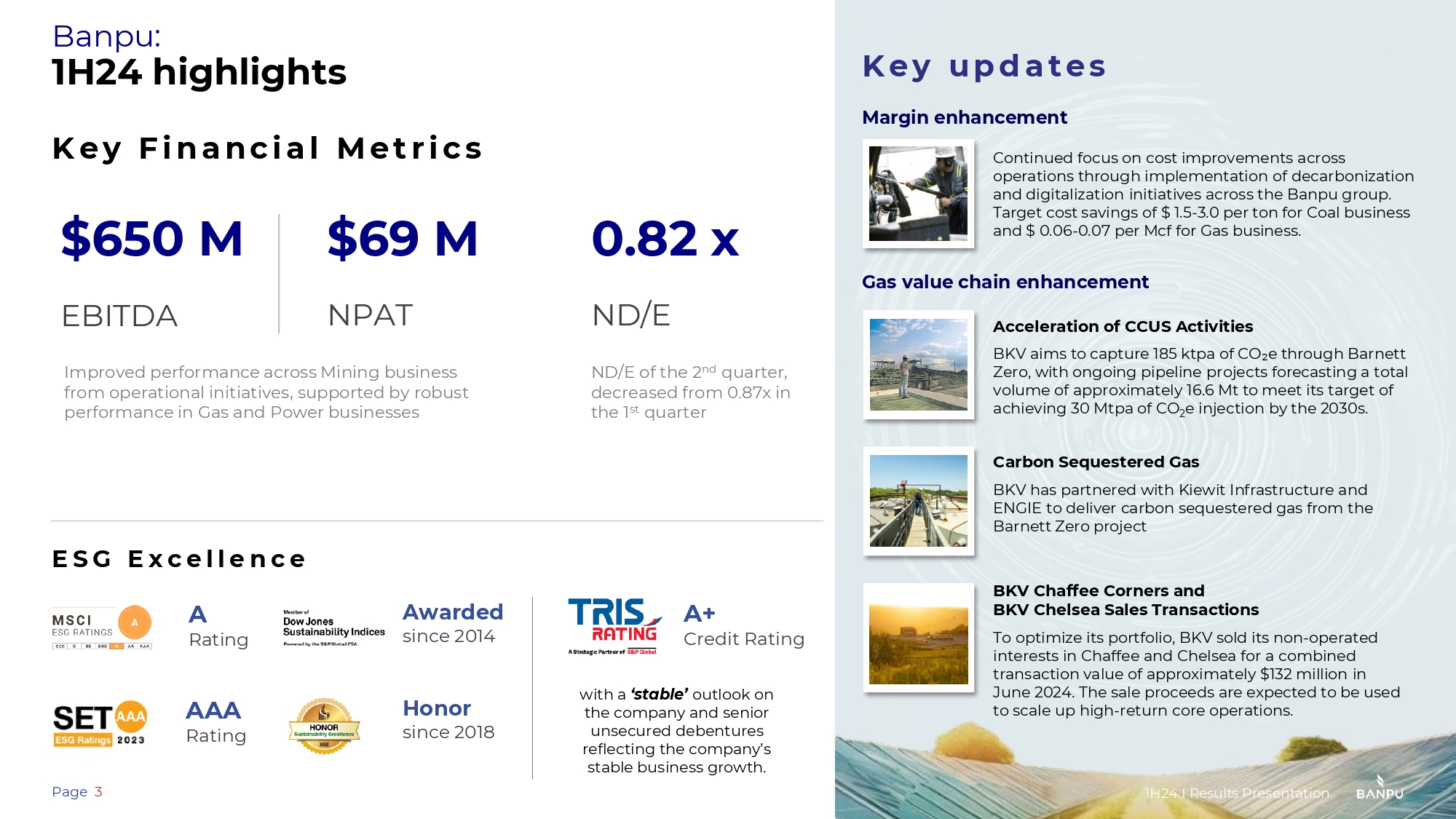

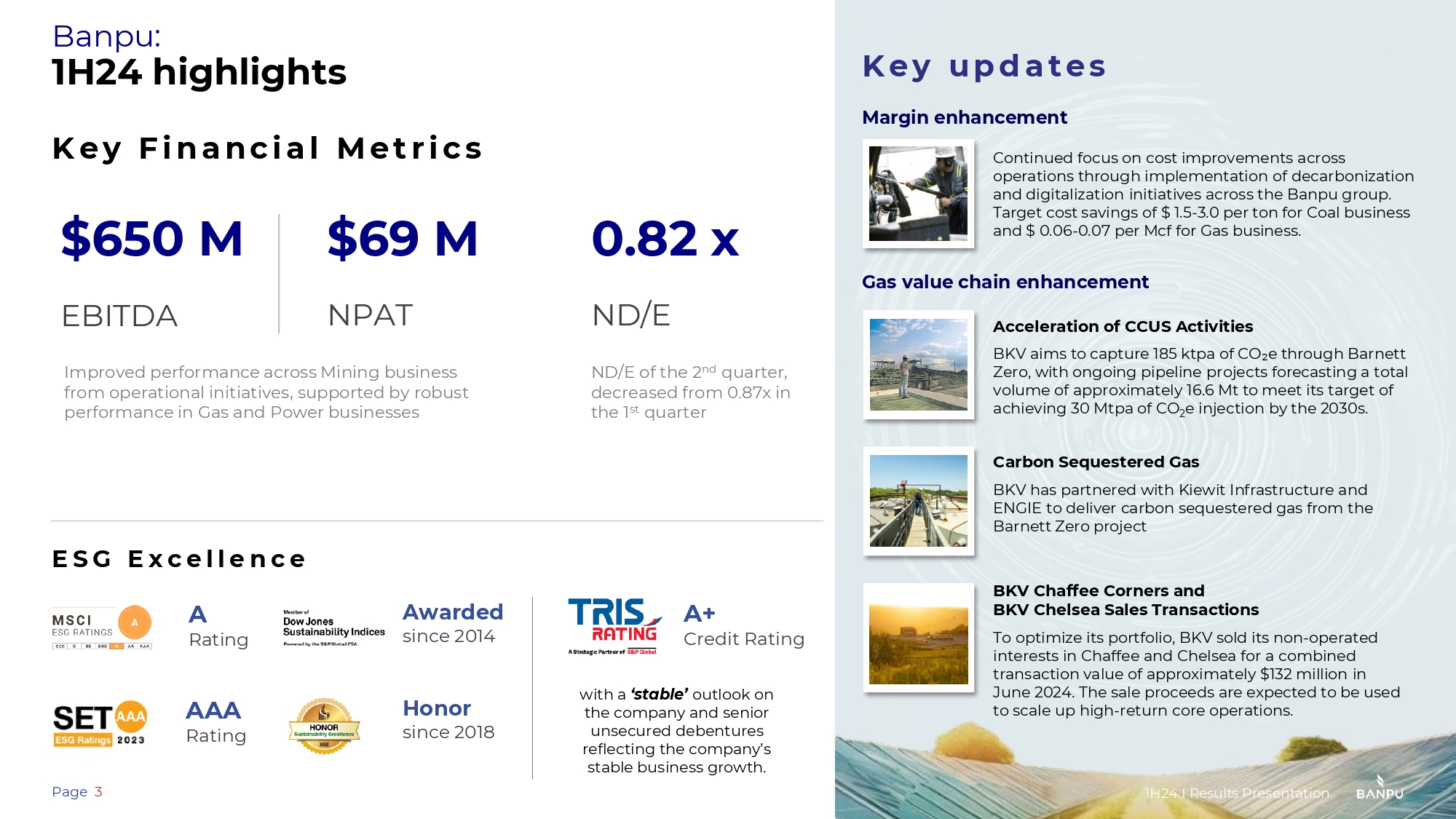

Chief Executive Officer of Banpu Public Company Limited (BANPU) Mr. Sinont Wongusolkit said the company expects EBITDA in the second half of the year. It will be around USD 650 million in the first half of the year. From consistently good cost control

Coal business will enter the winter peak season, which will have a positive impact on the demand for more coal. Coal prices started to increase from the first half of the year and the average selling price reached USD 94 per tonne. It is considered to be at a high level, however, the price trend is increasing. In addition, we can continue to control costs and prices. This is expected to support the coal business in the coming period.

The company has targeted coal sales of 40.8 million tonnes this year, split between 26 million tonnes in Indonesia, 8.8 million tonnes in Australia and 6 million tonnes in China.

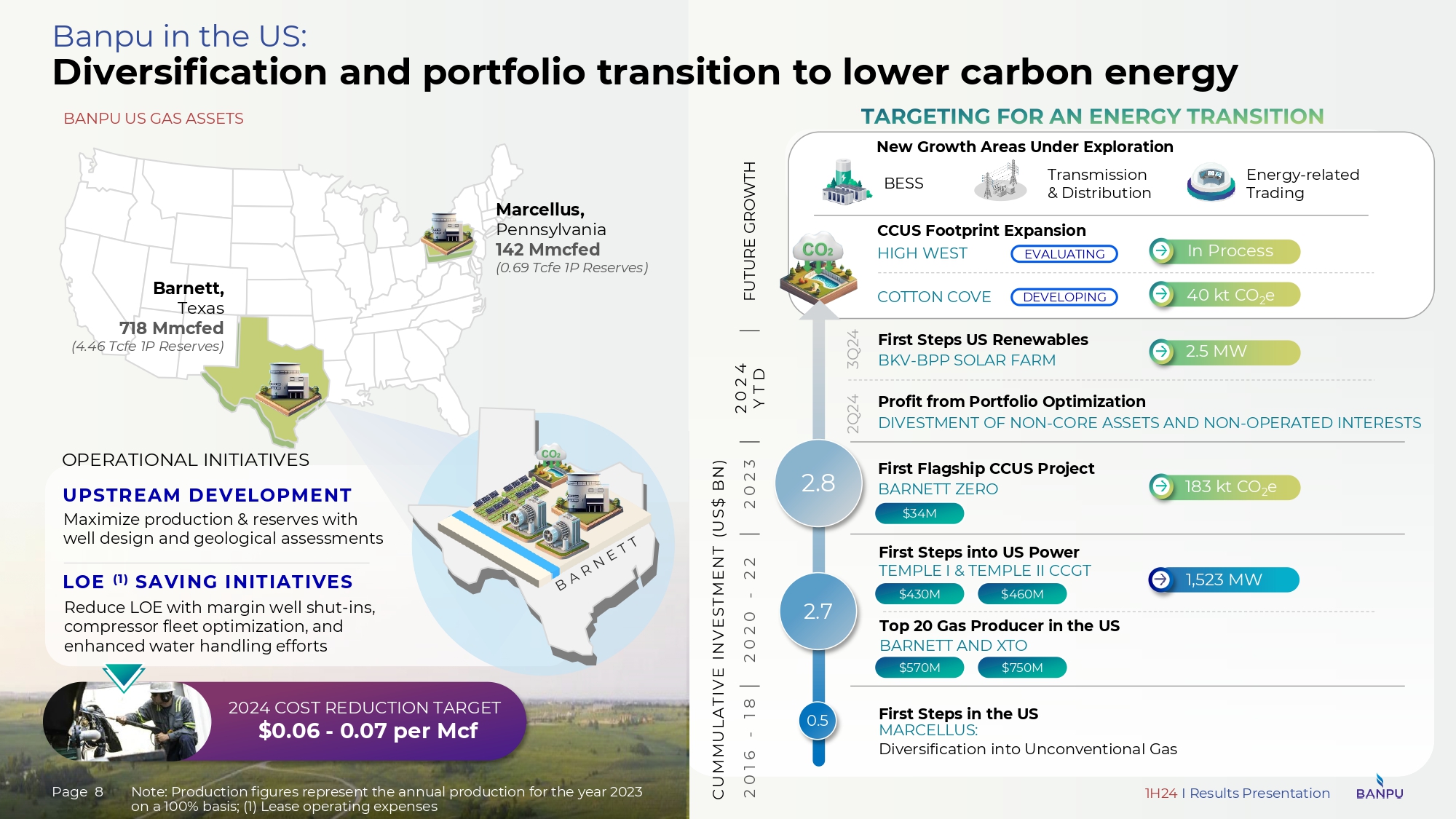

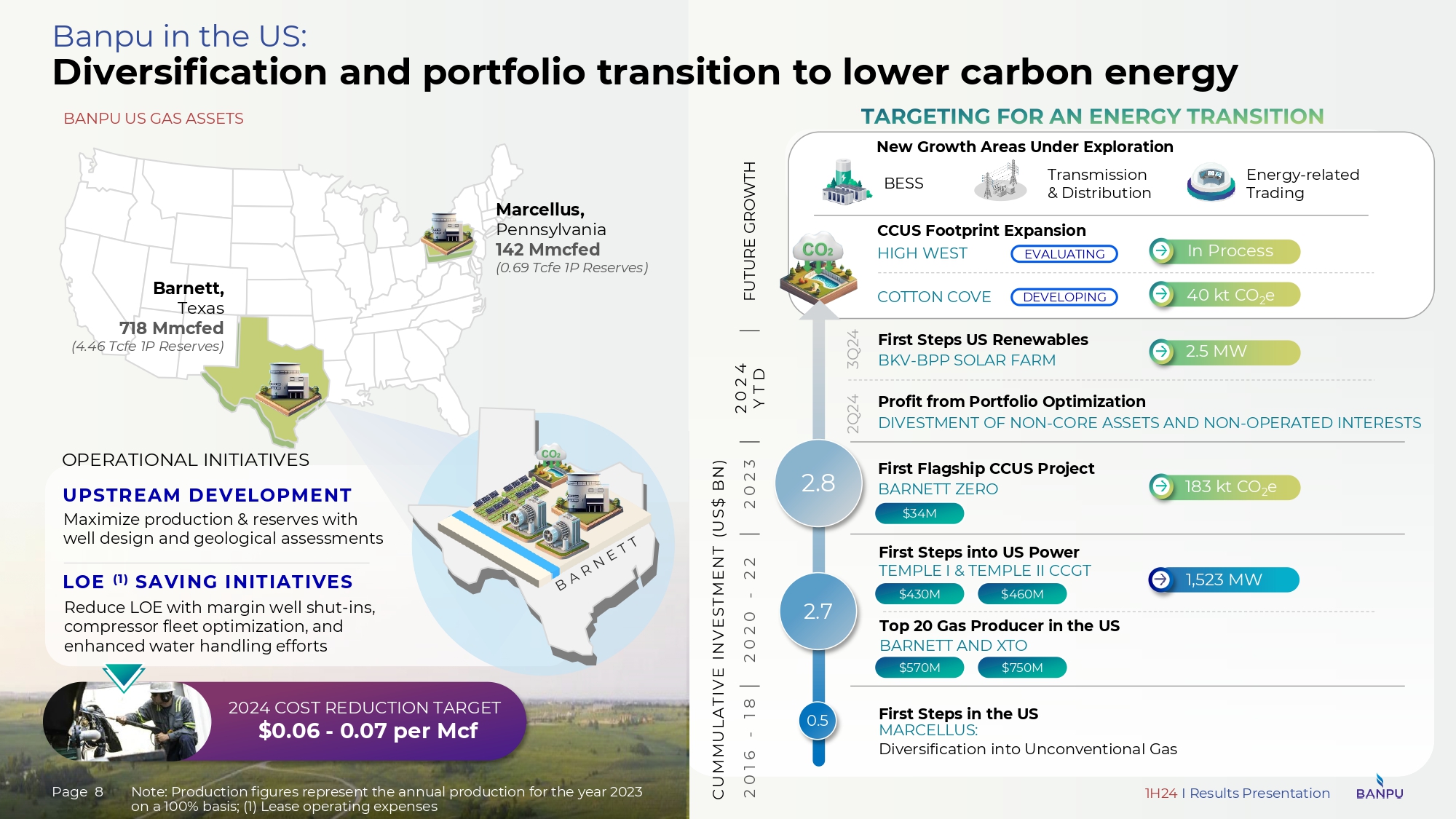

The natural gas business has experienced declining supply in the past. Several manufacturers in the US have announced investment delays. Help support gas prices. Let's fix that a bit. Meanwhile, in the second half of the year, investment is still initially delayed, which is expected to have a positive effect on gas prices. Storage is expected to decrease in October, including the 4th quarter of 2024 entering winter, pushing up gas prices further. Currently, the average gas price is $2 per million BTU.

Additionally, subsidiary BKV Corporation (BKV) ENGIE Energy Marketing NA, Inc. and Kiewit Infrastructure South Co. It has signed a carbon neutral natural gas purchase agreement with the project and is expected to be able to supply gas by the end of 2024, once certified by the US Carbon Registry.

The Ponder Solar Project, a 2.5 MW solar power plant located in the Barnett gas field in Texas, is scheduled to begin commercial operations in August 2024. The company owns and operates upstream and midstream businesses in the natural gas business, which is an important step for BKV to achieve its goals of reducing 2 greenhouse gas emissions.

Achieving BKV's net zero greenhouse gas emissions will directly and indirectly reduce greenhouse gas emissions. Use self-generated power from renewable energy sources such as the Ponder Solar Project and the CCUS Project to reduce dependence on outside electricity purchases and reduce greenhouse gas emissions for the Company and other organizations.

As for the power generation business, the company is interested in bidding to sell electricity from renewable energy in a new round of 3,000 MW, while awaiting clarity from government agencies on submission of documents. The company is also interested in trading power from renewable energy in the form of Direct Power Purchase Agreements (Direct PPAs) through a 2,000 MW pilot.

Mr. Sinon said. This year, an investment budget of around US$ 350 million has been set. To support gas business 50% and renewable energy 50%

Meanwhile, plans to bring BKV Corporation (BKV), a major natural gas commercial operator and gas-fired power plant, to the U.S. are progressing. The company is now well-positioned as it is listed on the New York Stock Exchange. But I am waiting to see the surrounding situation first.

By InfoQuest News Agency (15 August 2024)

Tags: BANPU, Sinon Wongkusonkit