The Investment Analysts Association expects Thai stocks to reach 1,535 points at the end of the year, with earnings per share reduced to 92.92 baht, while the average EPS growth is 14.31%. Check out the four outstanding stocks that analysts voted for similarly here!

Mr. Sombat Narawuthichai, Secretary-General Society of Investment Analysts Disclosing the results of a survey of analyst members and mutual fund managers from 24 agencies regarding the investment perspective in the second quarter of 2024-4/24, it turns out that the average forecast of earnings per share (EPS) for 2024 is 92.92 baht, which is down from The previous survey result was 95.62 baht and the average EPS growth for 2024 is expected to be 14.31%.

In terms of predicting the short-term direction of Thai stocks during the second quarter of 2024, the majority expect them to trend in a positive direction. It will close at the end of the quarter at 1447 points, and when looking at the entire year it will fluctuate in the range of 1329-1548 points, closing the year at 1535 points.

The IAA survey sees SET's trend still positive at the end of the year, reaching 1,535 points, but lowering EPS to 92.92 baht.

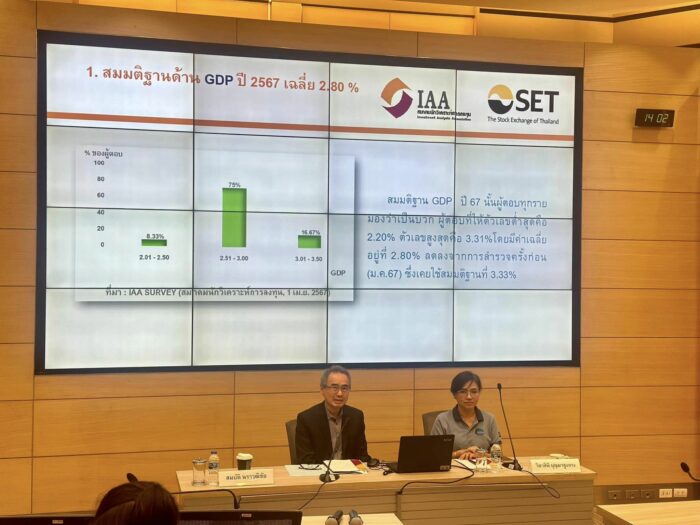

Key assumptions

- The average price of crude oil this year is $82.36 per barrel.

- The expected Thai GDP expansion in 2024 has fallen from the original 3.33% (January 2024) to 2.80%.

- The risk-free rate used in the average evaluation is 2.71%.

- The average risk premium in the stock market is 8.13%.

The factors affecting the direction of investment until the end of 2024 are divided into:

Positive factors More than 50% of the participants voted, led by the direction of interest rates in the country, the direction of interest rates in the United States and the local economy, and there were 83.33% of the participants. The next factor, 70.83%, voted in favor of the operating results of listed companies in 2024. Followed by inflows of funds from abroad into the Thai stock market. And foreign economic factors, including America, Europe and Asia, where the percentage of participants reached 66.67%, respectively.

Negative factors There was only one factor that received more than 50% of the votes: political factors abroad, which received 62.50% of participants.

Regarding the Bank of Turkey’s interest rate expectations at the end of 2024, there are 45.83% of analysts who expect it to be reduced by 0.50% and 0.25%, with 8.33% of participants who see it as stable.

Analysts recommend diversifying the investment portfolio and dividing it into:

- Cash and short-term deposits 8.33%

- Debt funds 23.54%

- Foreign stocks or equity funds 28%

- Thai stocks or Thai stock funds 23.46%

- Real estate funds or REITs 7.81%

- Gold or gold funds 7.81%

- Other assets such as Bitcoin and oil 1.04%

Opinions on foreign investment It is recommended to invest in US stock funds, especially in the technology sector and selective Asia such as China, India, Korea and Vietnam.

As for investing in Thai stocks, it is recommended to overweight investments in the business category. Food & Drink Consumer Products Capital/Securities Contractor Building and Tourism with reduced investment weight in the banking and insurance sectors.

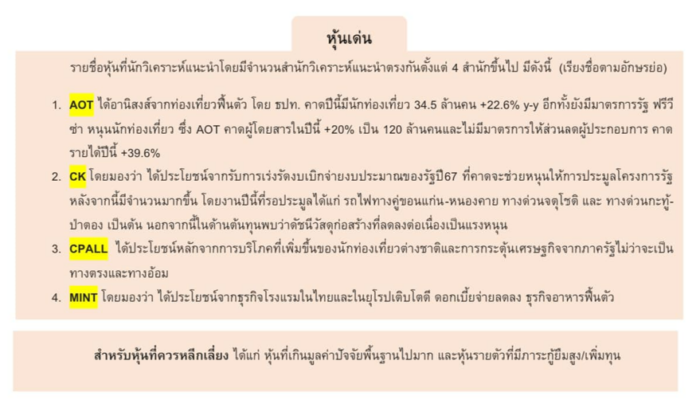

The list of stocks recommended by analysts from 4 or more companies is as follows (ordered by abbreviation)

- AOT Benefiting from the recovery in tourism, the Tourism Bank expects that this year there will be 34.5 million tourists + 22.6%. There is also a government procedure for obtaining free visas. AOT expects the number of passengers this year +20% to reach 120 million people, and there is no procedure to give discounts to operators. Expected income this year +39.6%

- CK Benefiting from accelerating the disbursement of the state budget in 2024. Encouraging more auctions for government projects after that. The works awaiting auction this year include: Khon Kaen-Nong Khai double-track railway, Chatochut Expressway, Kathu Patong Expressway, etc. In addition, in terms of costs, it was found that the building materials index continued to decline.

- CPALL The main benefits are an increase in the number of foreign tourists and economic stimulus from the government.

- Mint Benefit from the good growth of hotel business in Thailand and Europe. Interest expenses decreased Food business is recovering

Stocks to avoid include stocks that are significantly overvalued due to their fundamentals. and individual stocks with a high borrowing burden/capital appreciation

Read more news

follow us on

Involved

Follow us

“Reader. Infuriatingly humble coffee enthusiast. Future teen idol. Tv nerd. Explorer. Organizer. Twitter aficionado. Evil music fanatic.”