The following is from a recent issue of Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these and other on-chain Bitcoin market insights straight to your inbox, subscribe now.

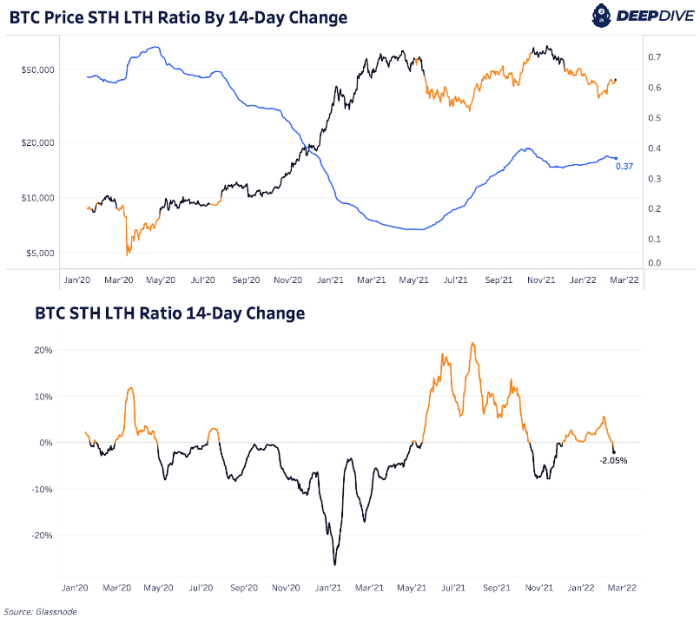

One of our favorite series indicators has recently flipped to the upside. The cost ratio based on the cost of STH (Short-Term Carrier) and LTH (Long-Term Carrier) has recently started to decline over the past two weeks, indicating a shift in market conditions.

The scale is first explained in detail in Daily Dive # 070.

Historically, the scale has been one of the most accurate market indicators for Bitcoin, as the relationships between the short- and long-term holders and the acceleration/deceleration of the cost basis of the two groups involved are very beneficial.

While it is true that the short-term holders are still underwater in aggregate (relative to the average cost basis of the group), the market has absorbed a lot of losses over the past few months, and with a relative backlog, its STH LTH ratio has flipped backward upwards.

The backtest of the ratio over time speaks for itself:

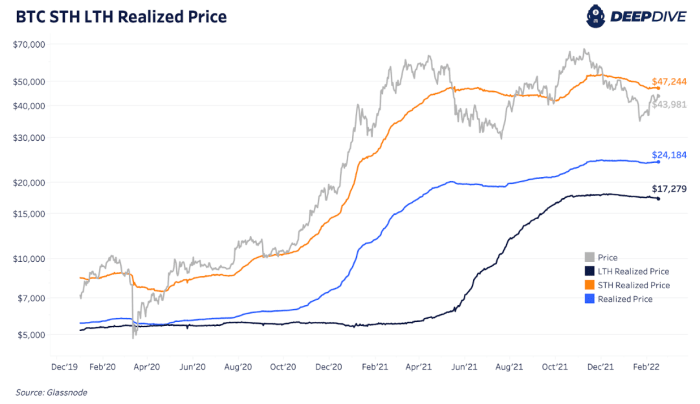

Here is a display of the inputs that go into the same ratio:

Similarly, last Wednesday in Daily Dive #144 We highlighted the upside in the delta gradient, which is another measure of market momentum.

“Reader. Infuriatingly humble coffee enthusiast. Future teen idol. Tv nerd. Explorer. Organizer. Twitter aficionado. Evil music fanatic.”