According to the report “Bitfinex Alpha” Latest market edition Bitcoin futures They face higher funding rates, indicating a premium on long positions and a further correction in spot rates.

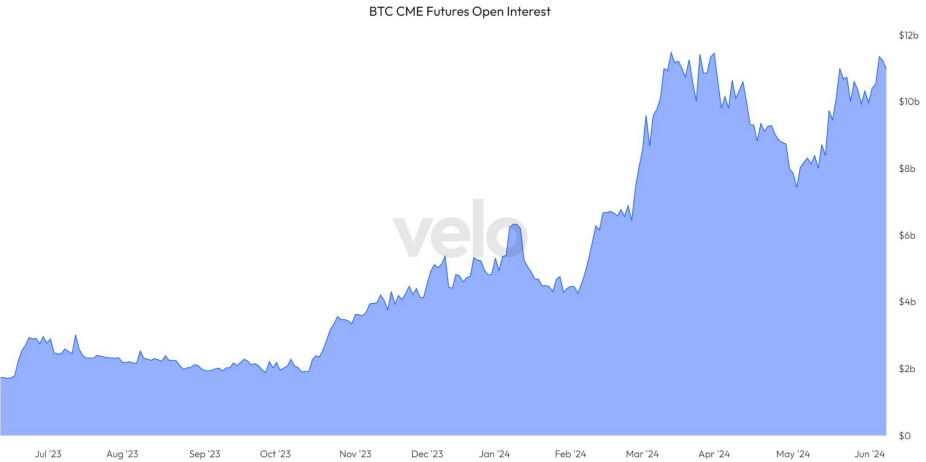

Open interest in CME Bitcoin futures rose to $11.4 billion as of June 4, matching the March peak before the major correction. However, many traders use fundamental arbitrage strategies to sell Bitcoin in the spot and long market through ETFs. Profit from the difference. The price that happens

Despite 20 consecutive days of ETF inflows since May 10, potential chaos looms with the US CPI report. This is about to happen and the Federal Open Market Committee's interest rate discussion is about to happen. Scheduled for this week

In the past week, Bitcoin's price has been volatile, reaching highs above $71,500 and then correcting to lows around $68,500, with major altcoins including Ethereum (ETH) and Solana (SOL) falling 7.5% and 12.1%. % respectively

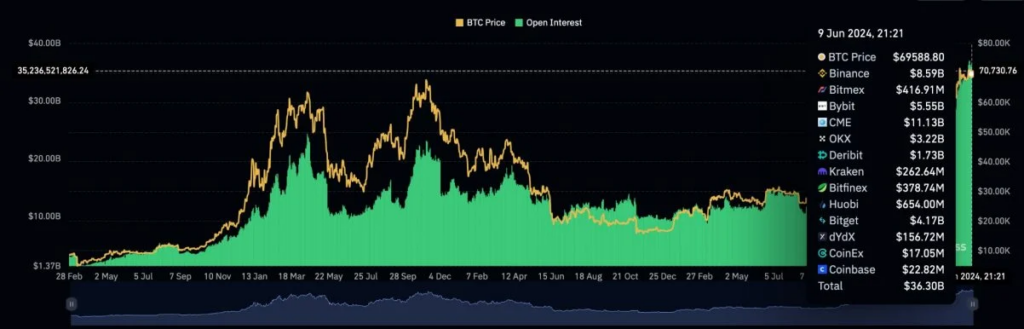

The recent “leverage influx” has seen massive liquidations in long altcoins, with Coinglass data showing open interest in Bitcoin at an all-time high of $36.8 billion on June 6.

Meanwhile, short-term investors have been more active in Bitcoin, with their holdings peaking at 3.4 million BTC in April. Long-term investors, in turn, show their confidence in this asset by continuously accumulating it. As a result, the inactive supply of Bitcoin among its long-term holders for one year remains stable.

As for the major bookmakers, Bitcoin is in the process of accumulating. With their balance reaching a new all-time high.

Therefore, although the derivative data points to a short-term price correction, factors such as increased ETF buying activity, lower selling pressure from long-term holders and better liquidity can stimulate Bitcoin's long-term movement.

source: cryptobriefing

“Reader. Infuriatingly humble coffee enthusiast. Future teen idol. Tv nerd. Explorer. Organizer. Twitter aficionado. Evil music fanatic.”