main socket

- Bitcoin jumped 20% after printing a low of $17,600 this weekend.

- Meanwhile, the price of Ethereum is up more than 29% from the $880 low.

- Both origins reached critical resistance areas after the recent recovery.

Share this article

Ethereum has taken the lead in reviving the recent cryptocurrency market, outperforming Bitcoin. However, both originals seem to have more room to go up.

Bitcoin and Ethereum Rise

The two largest cryptocurrencies by market capitalization, Bitcoin and Ethereum, appear to be poised to recover from the recent market pullback as technical indicators turn bullish.

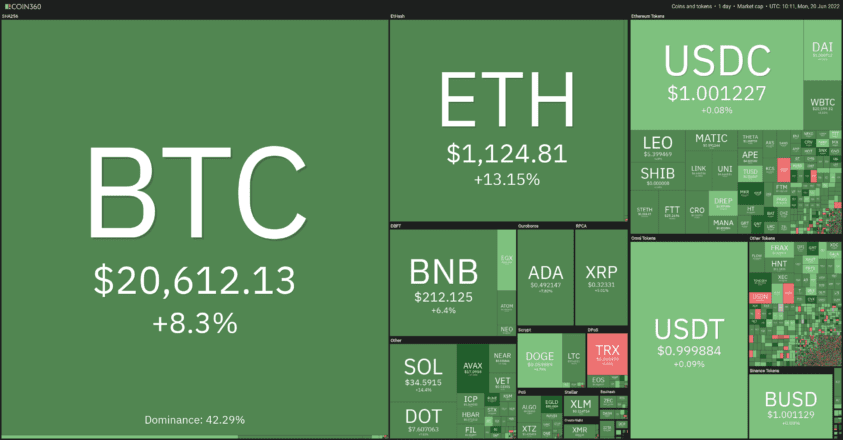

The cryptocurrency market started the week with renewed confidence as it gained over $100 billion in value in 24 hours. The sudden recovery came after Bitcoin, Ethereum and many other assets printed new annual lows on June 18, with Bitcoin dropping below $20,000 for the first time since December 2020. With the market pulling back, the erratic price action generated more than $900 million. Liquidations across all major digital derivatives exchanges.

Ethereum is the top performing asset among the top five cryptocurrencies by market capitalization in the recent rally. It traded as low as $880 and rose more than 29%, reaching a local high of $1140. Meanwhile, bitcoin has jumped nearly 20% since its slide on June 18.

Despite the significant recovery that both Bitcoin and Ethereum recorded over the past few hours, both assets could be poised to rally higher.

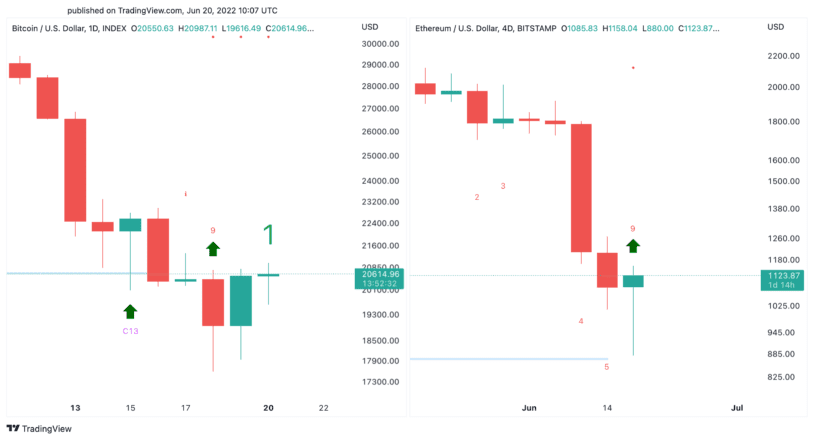

The Tom DeMark (TD) sequential indicator provided buy signals on the daily Bitcoin chart and the four-day Ethereum chart. Bullish formations developed in the form of nine red candles, anticipating ascending waves in the future. This type of technical pattern indicates a rise of one to four candles.

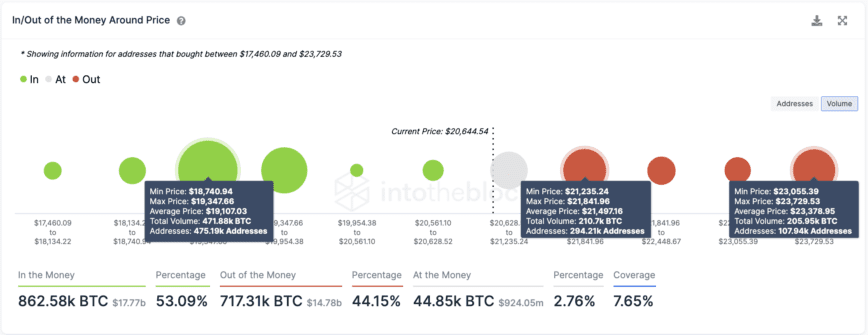

Transaction history shows Bitcoin facing stiff resistance at $21,500, with nearly 300,000 addresses previously buying more than 210,000 coins. If the leading cryptocurrency can break through this wall of supply, it could gain strength to advance to the next hurdle at $23,730.

It is worth noting that Bitcoin needs to hold above the $19,100 support level to validate the optimistic forecast. Failure to do so could result in further sell-offs of up to $16,000 or even $14,000.

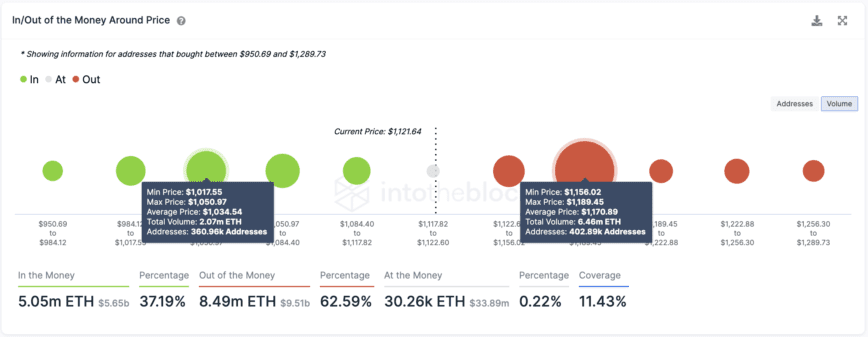

Meanwhile, Ethereum must overcome the $1,200 resistance level to validate the buy signal provided by TD Sequential. The recovery of the previous resistance could increase buying pressure, which could send Ethereum to $1800. Ethereum needs to hold above $1,000 to avoid printing lower bottoms, as a prolonged pullback could lead to a crash to $700.

While technical indicators are showing early signs of a local bottom, the macroeconomic outlook does not favor the bulls. The Federal Reserve’s commitment to raise interest rates It has become a major concern for cryptocurrency investors and global financial market participants alike as high interest rates tend to hurt risky assets. Moreover, many economists have warned of a looming long-term recession, which will lead to mass layoffs at some of the largest cryptocurrency exchanges.

The cryptocurrency market has been hit hard amid a gloomy macro outlook, with the global cryptocurrency market cap at around $946 billion, down about 68% from its peak in November 2021. For Bitcoin and Ethereum to continue their upward trend, they will need to fight fears and stay above support. . If they succeed, they may have a chance to lure investors back into the market.

Disclosure: At the time of writing, the author of this article is owned by BTC and ETH.

For more major market trends, subscribe to our YouTube channel and get weekly updates from lead bitcoin analyst Nathan Batchelor.

Share this article

“Reader. Infuriatingly humble coffee enthusiast. Future teen idol. Tv nerd. Explorer. Organizer. Twitter aficionado. Evil music fanatic.”