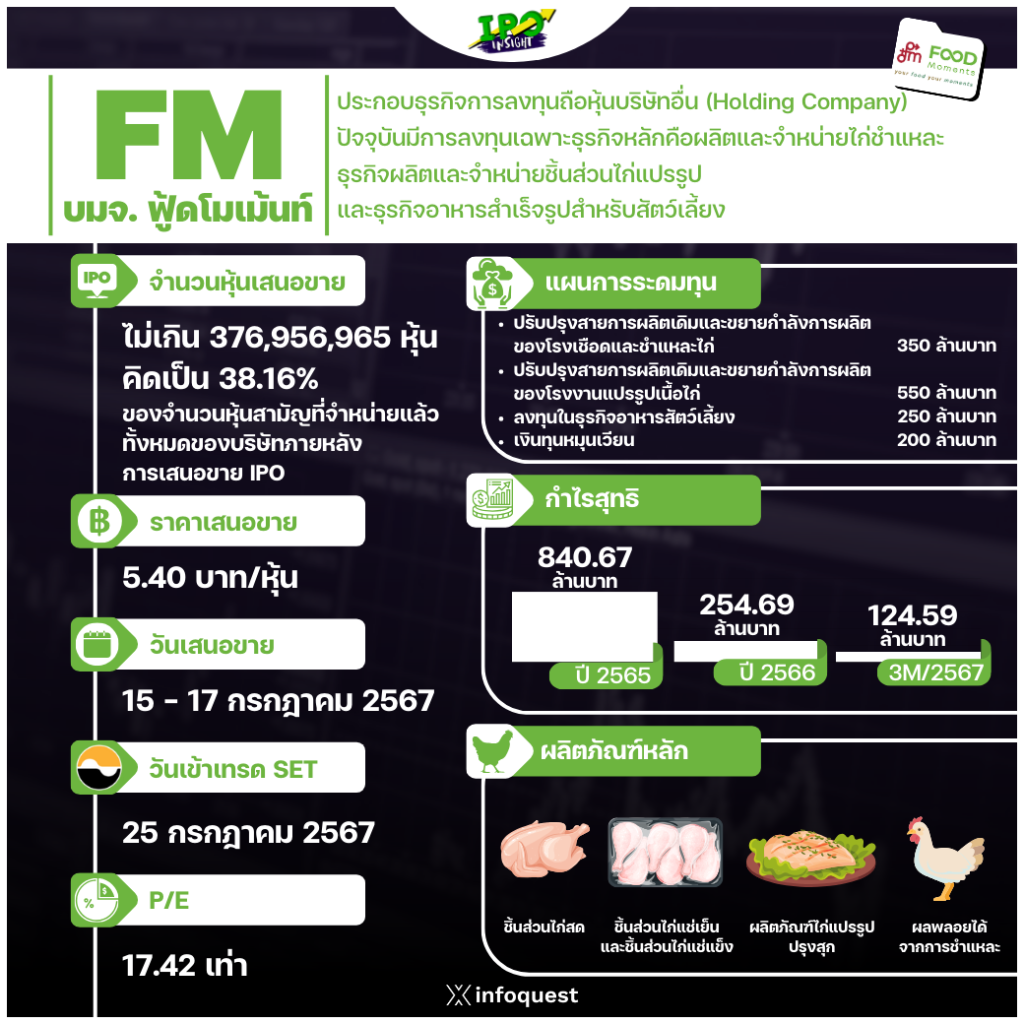

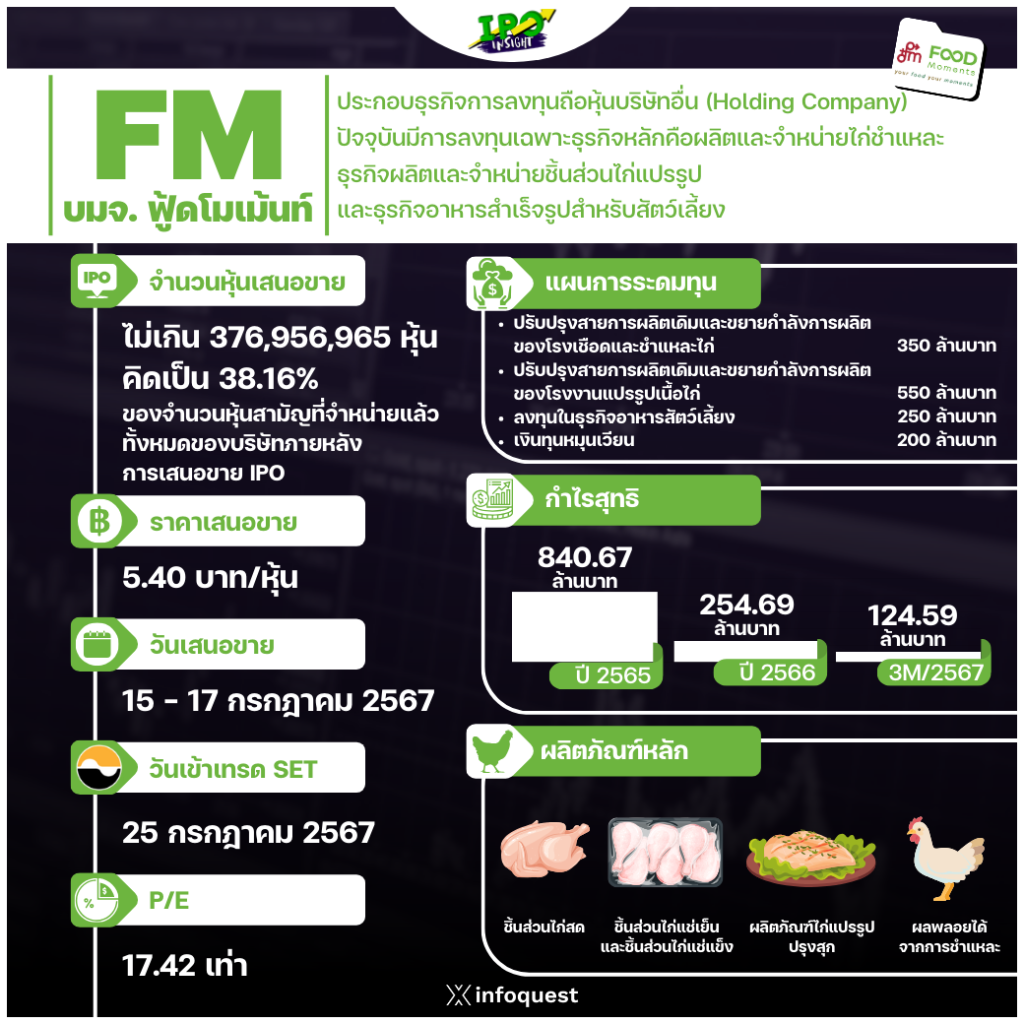

Food Moment Public Company Limited (FM), a premium export-focused chicken processing company, is offering up to 376,956,965 shares for public subscription to be used to increase production capacity and expand new businesses. It was listed on the SET Stock Exchange in the food and beverage category on July 25, with an IPO price of 5.40 baht.

FM is a holding company engaged in investing in shares of other companies. The main business is the production and sale of slaughtered chicken, which accounts for 62% of the total revenue. The remaining 38% is the production and distribution of processed chicken parts. (Cooked Value Added:: CAV Products) If broken down by distribution channel, the current revenue from domestic sales is 47%, while the remaining 53% is exported to more than 10 countries, such as Japan, Europe, Singapore, etc.

The company is also preparing to branch out into a new business line that represents a business trend with high growth potential in the current era, namely pet food, as a channel to bring the product from the broiler processing process to create the highest value. The funds raised from the fundraising will be used through cooperation with partners already in this business. At this time, negotiations are open for 2-3 cases.

FM CEO Natthaphon Dusadenod said the company has a target in its 3-5 year business plan to increase the revenue share of processed chicken parts production and distribution from the original 38% to 60% of total production and sales. As a high gross profit margin company, the remaining 40% will come from the slaughtered chicken production and sales business.

As well as targeting to increase the percentage of revenues in the export channel from 53% to 65% by continuing to expand in the international market. To support such goals, the company has developed a strategy to find new markets, especially the Middle East market. The largest market is the United Arab Emirates, which can be said to be a market with very high potential. It is one of the top 10 importers of chicken from all over the world.

“Previously, very little chicken was exported from Thailand due to trade restrictions between different countries, but this year the good news is that the restrictions are closed there. Now that we have started talking to a large group of importers, we believe that around Q4 2024 we should start shipping frozen raw chicken meat. Next year, we will expand to the ready-made chicken section. Mr. Nataphon said.

Mr. Nattapon said the next markets to enter next year are the Philippines and Saudi Arabia. Both countries are among the top 10 importers of chicken from around the world, and in the past, Thai chicken was also exported little, but now the trend of international trade is whether the government policy has become clearer. It is also a bright opportunity for Thai chicken to enter the market in these two countries.

Meanwhile, Mr. Sumit Masilirangsi, FM’s CFO, said the funds raised from the first part of the fundraising will be used to expand production capacity and increase production efficiency at the chicken slaughterhouse and abattoir. The current production capacity is 144,000 units/day, and we aim to increase the production capacity to 180,000 units/day.

While the second part of the raised funds will be used to expand production capacity and increase production efficiency. The current production capacity of the chicken processing plant is 27,000 tons per year, and we aim to increase it to 36,000 tons per year, and the capacity expansion plan for these two companies will be seen in 2026.

Another portion of the funds raised will be used to invest in adding value to the business. Currently, the slaughtered chicken business includes products such as chicken carcasses and chicken entrails. We see these two segments as potentially adding value to the company if we can turn them into part of the cost of producing pet food.

“We are looking for partners to invest in pet food production. Which can use chicken skeletons and chicken entrails as part of the production. Our partners must already have production facilities. Including an existing customer base. We are currently talking to two or three partners. We expect to be able to close the deal around 2026 and after that we may start generating some income from this business,” Mr. Sumit said.

Written by Phakamon Saikhonthod/Sasithorn Simaporn

Tags: FM, IPOInsight, SCOOP, SET, Stock Exchange, Instant Food, Thai Stocks, Pet Food, Premium Cooked Chicken, Frozen Frozen Chicken

“Reader. Infuriatingly humble coffee enthusiast. Future teen idol. Tv nerd. Explorer. Organizer. Twitter aficionado. Evil music fanatic.”